Neuroinflammation: Rethinking Treatment of Brain Disorders

After years of clinical setbacks and deprioritization in neuro drug development, could targeting the brain’s immune system as a new therapeutic hypothesis spark the next wave of FDA approvals?

Introduction

Over the past few decades, few therapeutic areas have drawn as much skepticism across biopharma, research, and investment circles as neurology.

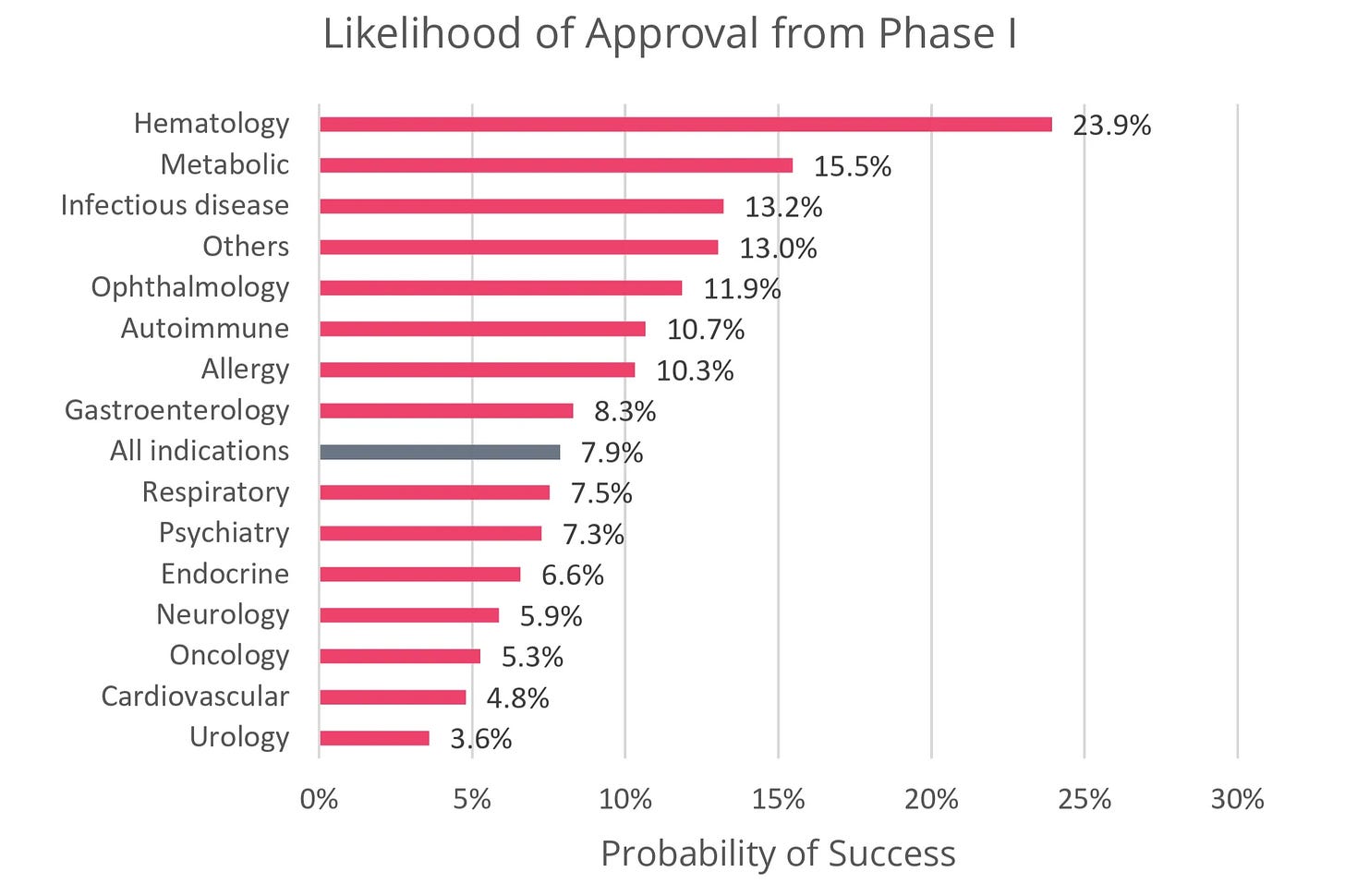

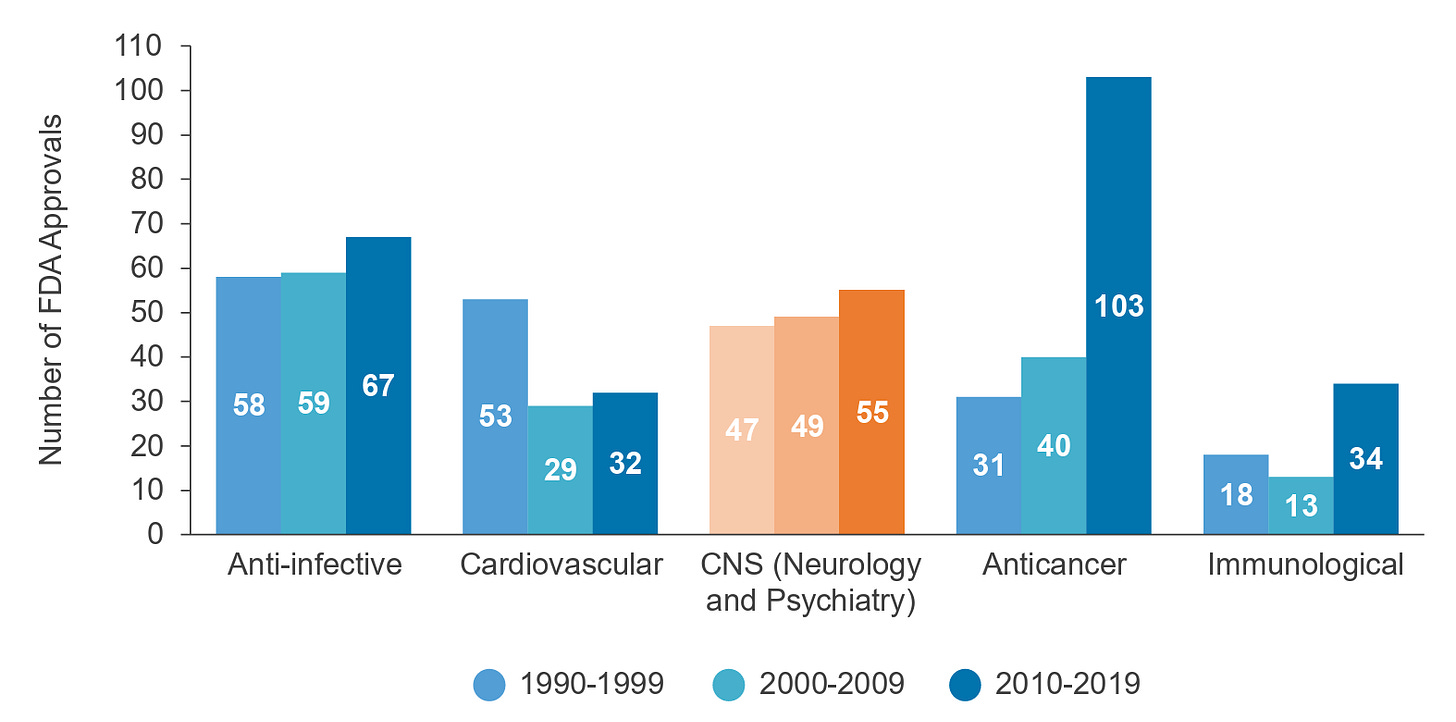

When looking at the numbers, this hesitation may be warranted. The average probability of a central nervous system (CNS) drug making it from Phase I to market is just 5.9% — the 4th lowest by therapeutic area (TA). The average time to approval is 11.1 years — the 3rd longest by TA. Moreover, unlike other indication spaces such as oncology and immunological diseases, the pace of new drug approvals in CNS has been relatively stagnant over the last 3 decades.

This reality is most visible in neurodegenerative diseases such as Alzheimer’s and Parkinson’s. For decades, the dominant therapeutic approach has focused on eliminating the hallmark protein aggregates (e.g. amyloid beta (Aβ), tau, α-synuclein) thought to drive disease progression. Yet in the last five years, this hypothesis has been at the center of high-profile article retractions, numerous clinical trial failures, controversial drug approvals, and subsequent discontinuations.

Today, despite decades of effort, only two disease-modifying therapies targeting protein aggregation are approved for Alzheimer’s. While these approvals suggest protein aggregation remains an important piece of the therapeutic puzzle, their overall cognitive benefits are modest, and their use is further clouded by characteristic safety issues that can prevent long-term adherence. Moreover, there are still no approved disease-modifying treatments for Parkinson’s.

Given these data, it’s easy for many outside the neuro field to develop a negative gut reaction surrounding the future of CNS drug development. I’ll be the first to admit that even as someone who dabbled in neuro research as a wet-lab scientist, there was a large part of me that felt this way too. But after spending more time diving deeper into the field’s history and emerging biological hypotheses, my perspective has shifted.

Through the lens of an initial skeptic turned hesitant optimist, this article explores why neurology drug development has been so difficult, how CNS investment by pharma and venture capital (VC) has evolved over time, and one emerging therapeutic hypothesis that could catalyze the development of novel disease-modifying therapeutics.

Table of Contents

Why should biotech, pharma, and VC be investing in neuro research?

How has CNS investment interest by pharma and VC evolved over time?

Clinical progress towards drugging neuroinflammatory targets

Why should biotech, pharma, and VC be investing in neuro research?

From a scientific and human health perspective, advancing our understanding of fundamental neurobiology and using that knowledge to develop treatments for CNS disorders is undoubtedly valuable to society.

However, from an investment standpoint — across biotech, biopharma, and VC — the prioritization of neurology can become less clear. With limited resources, investors and drug developers are forced to weigh which indications and therapeutic hypotheses should be prioritized, whether fundamental biological insights are mature enough to translate into clinical therapies, and if the field is at the right point on the technological J-curve to encourage investment.

In the current risk-off market, biotech investors and biopharma often favor indication areas with high probabilities of clinical success, relatively fast development timelines, and large market potential. As noted above, CNS disorders have historically scored poorly on the first two measures, which can explain some of the disproportionate deprioritization of this space.

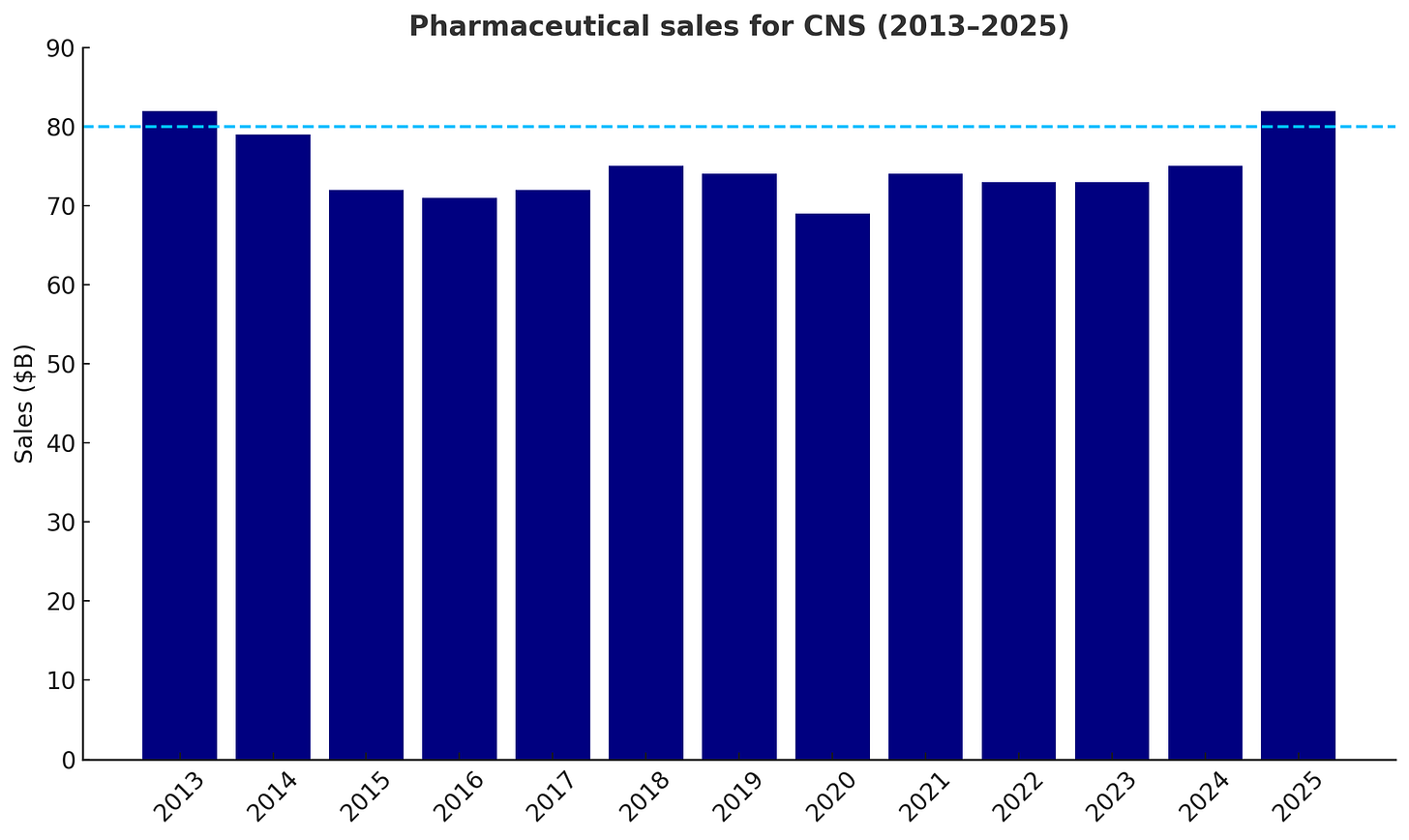

But the scale of the market opportunity and the substantial burden CNS disorders have on patients and broader society are significant, and there is increasing evidence that the market is growing out of an over decade-long slump. Specifically, the broader CNS market is poised to surpass $80B in 2025, corresponding to an ~8% year-over-year growth.

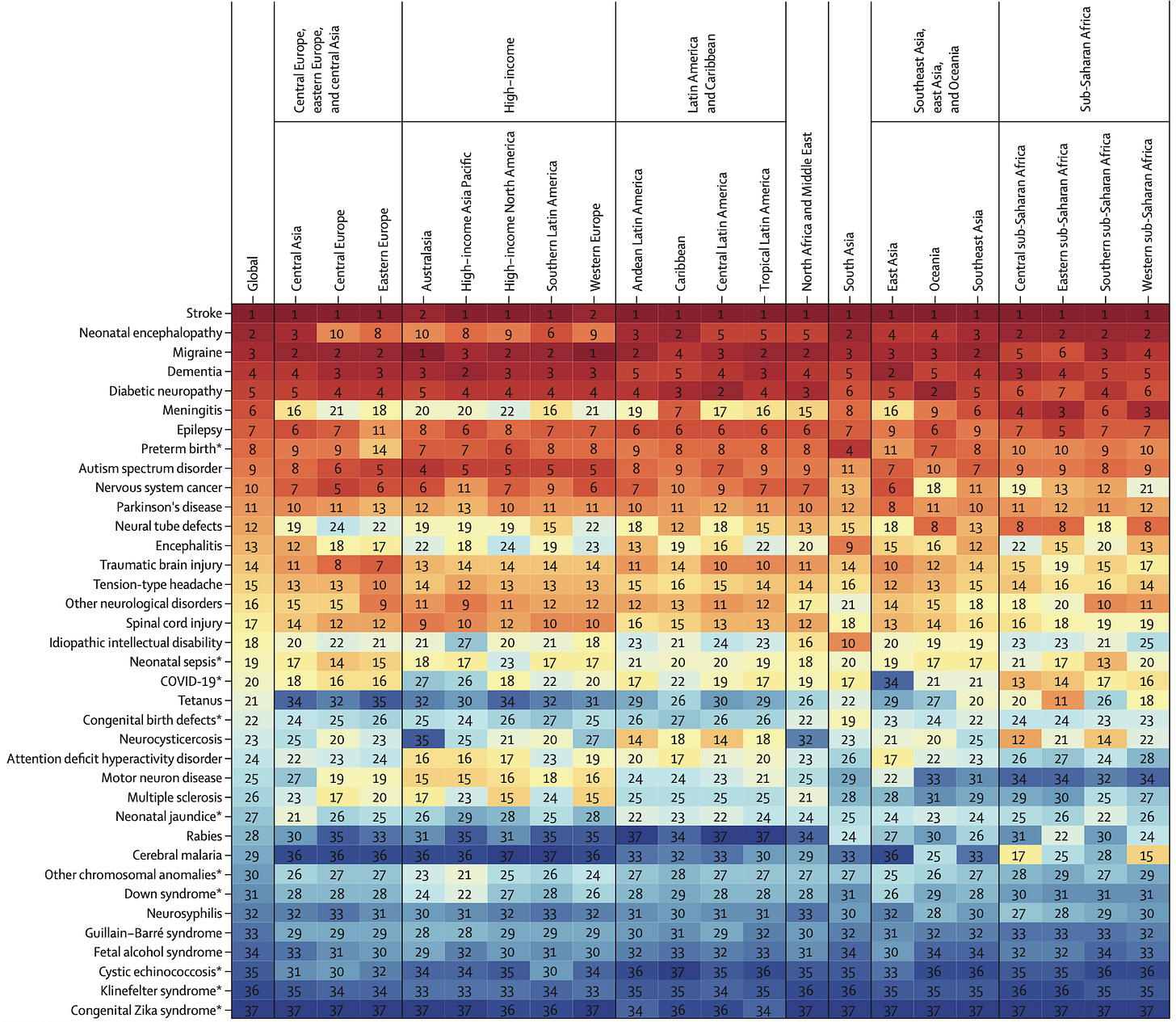

Perhaps even more striking is the socioeconomic burden. CNS disorders are the leading cause of overall disease burden worldwide. Collectively, they affect 43% of the global population and are responsible for 443M disability-adjusted life years (DALYs) — an increase of 18.2% over the last 30+ years. To put this into context, in 2019, it was estimated that early-onset cancers account for ~250M DALYs globally.

Between a growing market, massive socioeconomic impact, and heavy burden on patients, the question isn’t whether opportunity exists in CNS, it’s which catalysts can overcome the field’s unique developmental challenges, accelerate the approval of disease-modifying therapies, and spark broad investor interest.

Why is CNS drug development so difficult?

For many CNS disorders, current standard-of-care (SoC) therapies are decades old and often only manage symptoms. For example, in Parkinson’s disease, the dopamine precursor levodopa/carbidopa (Sinemet) has remained SoC since its approval in 1975, providing relief of motor symptoms but without altering disease progression. Similarly, propranolol, a nonselective beta blocker originally approved in 1967, is the only FDA-approved treatment for essential tremor.

Progress in CNS drug development has generally been slow because the brain poses a unique set of scientific, clinical, and logistical challenges that make drug development significantly more complex than most other indication areas:

Our fundamental understanding of neurobiology is limited compared to other tissues.

The CNS is arguably our most complex organ system, comprising billions of neurons with trillions of dynamic connections. Access to human tissue is scarce and tools for non-invasively measuring and manipulating its function are limited. This is further compounded by a lack of representative in vitro and in vivo preclinical models to study complex disease phenotypes that are often driven by several cell types — making novel target discovery and validation of new therapeutic hypotheses even more difficult.

CNS tissue has limited regenerative capacity.

Because mature neurons are post-mitotic, damage from disease or injury is often permanent. This limits the potential for reversing late-stage disease and focuses most therapies toward only slowing progression. Moreover, many CNS diseases do not present symptoms until irreversible damage has already occurred, complicating overall treatment strategies.

Clinical trials for CNS disorders are challenging to execute.

CNS diseases are heterogeneous and vary significantly across patients due to differences in genetic and environmental causes. As a result, there are relatively few reliable biomarkers that clearly link target engagement to clinical outcomes. Long disease courses and strict inclusion criteria make trials especially lengthy and expensive.

The blood-brain barrier (BBB) selectively limits drug delivery to the brain.

The BBB is a protective barrier of several cell types — most notably endothelial cells — and extracellular matrix that limit the passage of soluble molecules and cells between the peripheral circulatory system and CNS tissue. It’s estimated that only 2% of FDA-approved small molecules and <1% of an IV administered antibody dose cross the BBB. Researchers are working on both passive and active methods of drug delivery across the BBB, but our understanding of the optimal design heuristics is limited.

How has CNS investment interest by pharma and VC evolved over time?

After decades of searching, pharma finally found its initial breakout class of neurology drugs in the late 1980s with the FDA approval of Eli Lilly’s Prozac, a selective serotonin re-uptake inhibitor (SSRI) for treatment of major depression. By 1990, Prozac became the best-selling antidepressant of all time, and by 1998, it reached $2.8B in annual sales, accounting for a quarter of all Eli Lilly's revenue.

Several factors contributed to Prozac’s widespread success, including its relatively safe toxicity profile, convenient once-daily oral dosing, broad potential for indication expansion, and overall cultural resonance. But perhaps the most important factor for the neuro field at large was the breakthrough in validation of a new therapeutic hypothesis delivering clear efficacy and safety benefit to patients.

This novel biology sparked a wave of interest and investment across pharma — several developing their own “me-too” SSRIs, including Pfizer’s Zoloft in 1991 and GSK’s Paxil in 1992. Zoloft’s sales would ultimately go on to eclipse Prozac’s with a peak of >$3B in 2004. Soon after, the field expanded to related biological mechanisms, including serotonin-norepinephrine re-uptake inhibitors (SNRIs) such as Wyeth/Pfizer’s Effexor (1993) and Eli Lilly’s Cymbalta (2004).

However, by the mid-2000s, the market began to shift. The SSRI/SNRI space had grown increasingly crowded, and several early drugs lost patent protection, opening the door for generics to capture significant market share. Outside of psychiatry, the challenges of translating therapies across other CNS diseases came back into full view with years of clinical setbacks. For example, out of a total of 244 compounds tested in Alzheimer’s disease clinical trials from 2002-2012, only 1 (0.4%) gained approval. At the same time, while our biological understanding of CNS diseases stagnated, rapid advances in fields like oncology and immunology began to draw pharma attention and investment elsewhere.

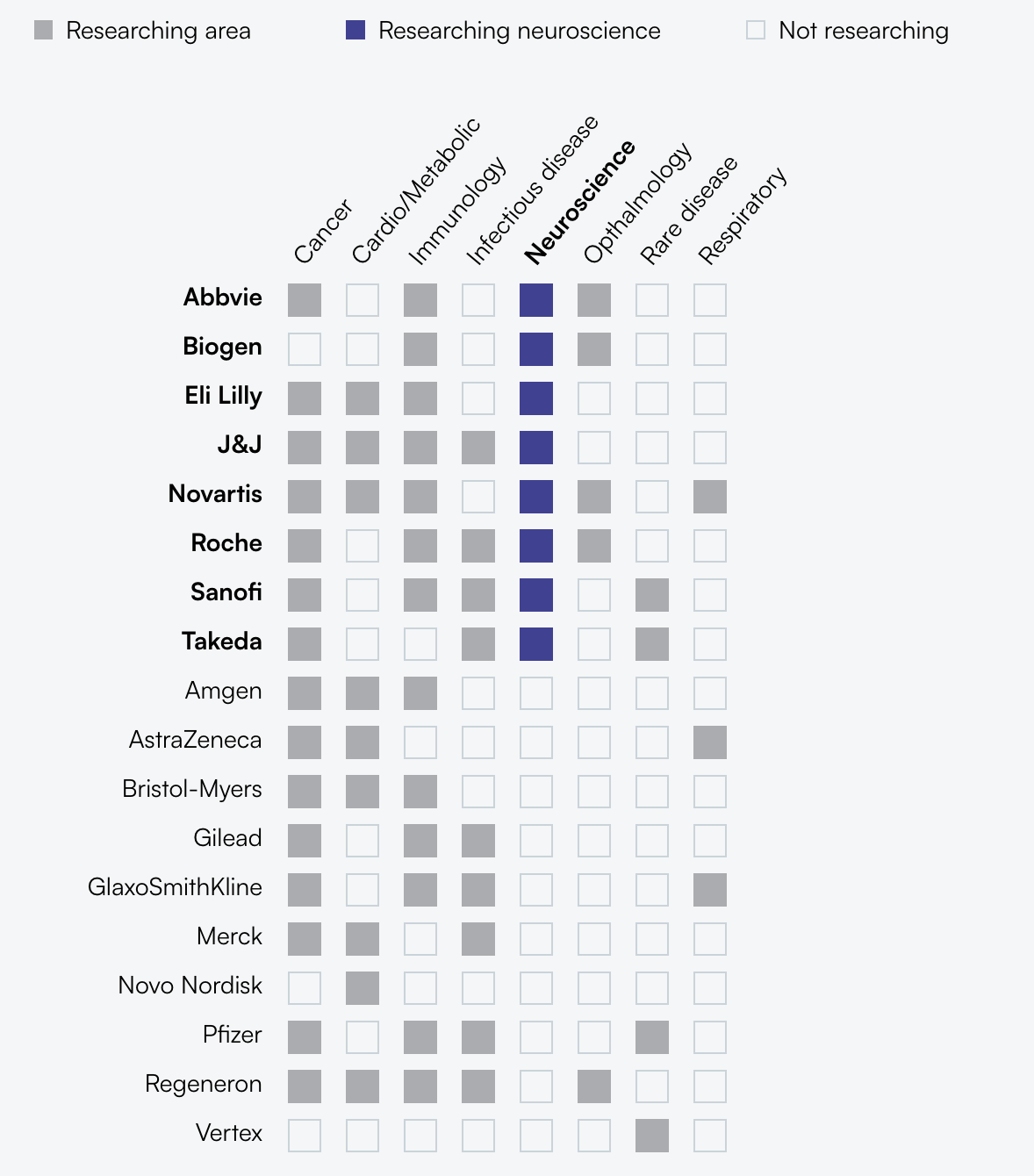

As a result, CNS pipelines shrank sharply between 2009 and 2014 with 11 major pharma reducing collective drug programs by 52% (267 to 129). Since then, several pharma have doubled down and announced major pullbacks from investment into CNS programs, including Amgen, Pfizer, and AstraZeneca.

“Upon careful evaluation of our pipeline and the challenges inherent in developing drugs for major neurologic diseases, we’ve made the decision to end our neuroscience research and early development programs…” — Amgen R&D Head, David Reese, October 2019

“We have made the decision to end our neuroscience discovery and early development efforts and re-allocate funding to those areas where we have strong scientific leadership and that will allow us to provide the greatest impact for patients.” — Pfizer, January 2018

“We cannot be everywhere. [CNS is] probably better managed by other companies that have a focus on that.” — AstraZeneca CEO, Pascal Soriot, May 2025

It’s unfair to say that all large pharma have pulled back from neuro investment. The table below shows several active players. That said, many of these pharma have scaled down from the peak levels of ~25 years ago, concentrating their portfolios on major neurodegenerative diseases such as Alzheimer’s, Parkinson’s, and multiple sclerosis (MS), while deprioritizing areas like psychiatric disorders, depression, and pain.

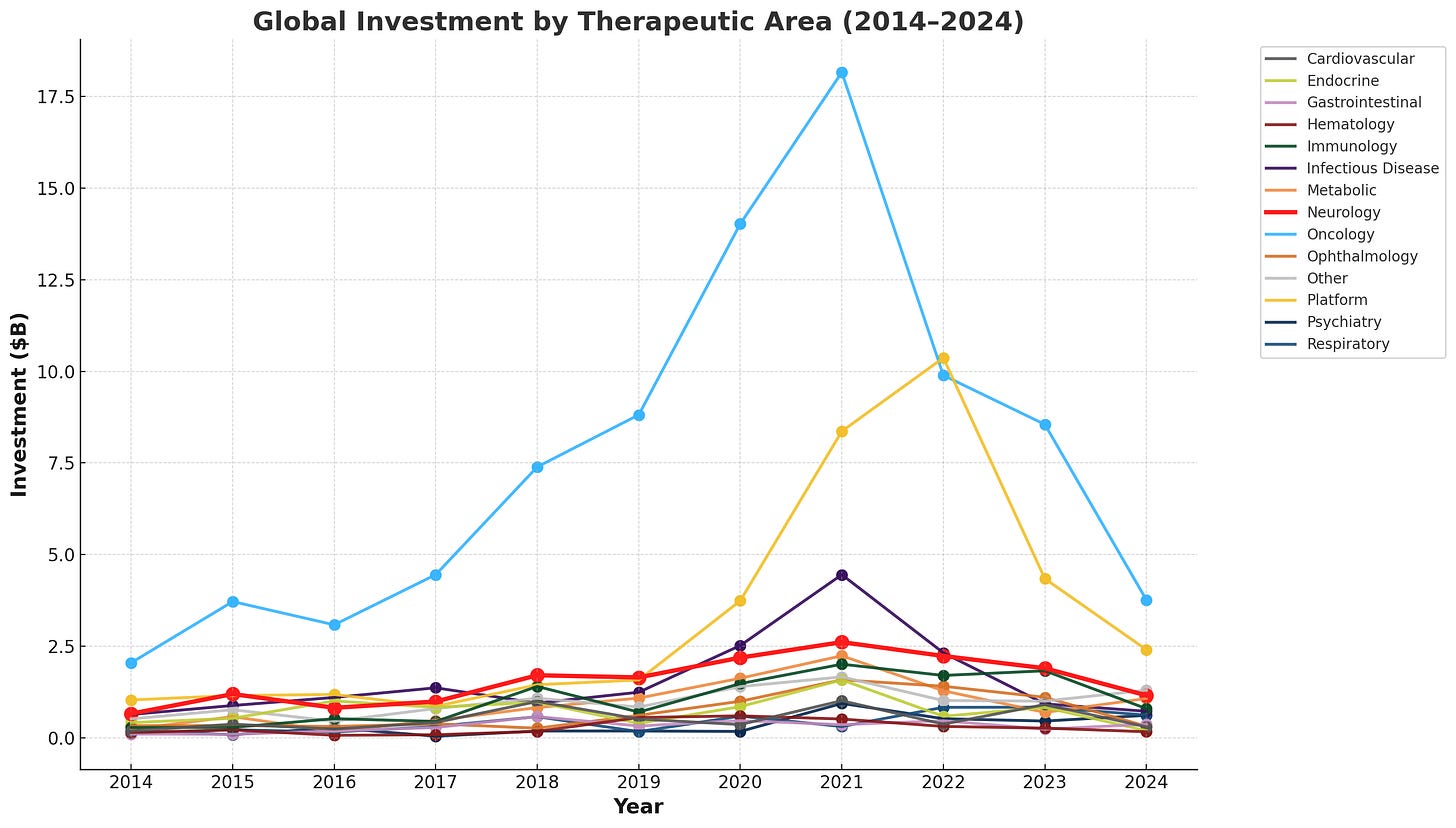

Interestingly, while pharma largely deprioritized neuro during this time, biotech venture investment remained relatively resilient — consistently ranking as the 2nd or 3rd highest therapeutic area by dollars — showing that investor sentiment did not necessarily shift in the same way as pharma. It’s impossible to assign a singular reason for this funding trend, but the combined large patient population and active mergers and acquisitions (M&A) market may have been enough to keep VC investors interested.

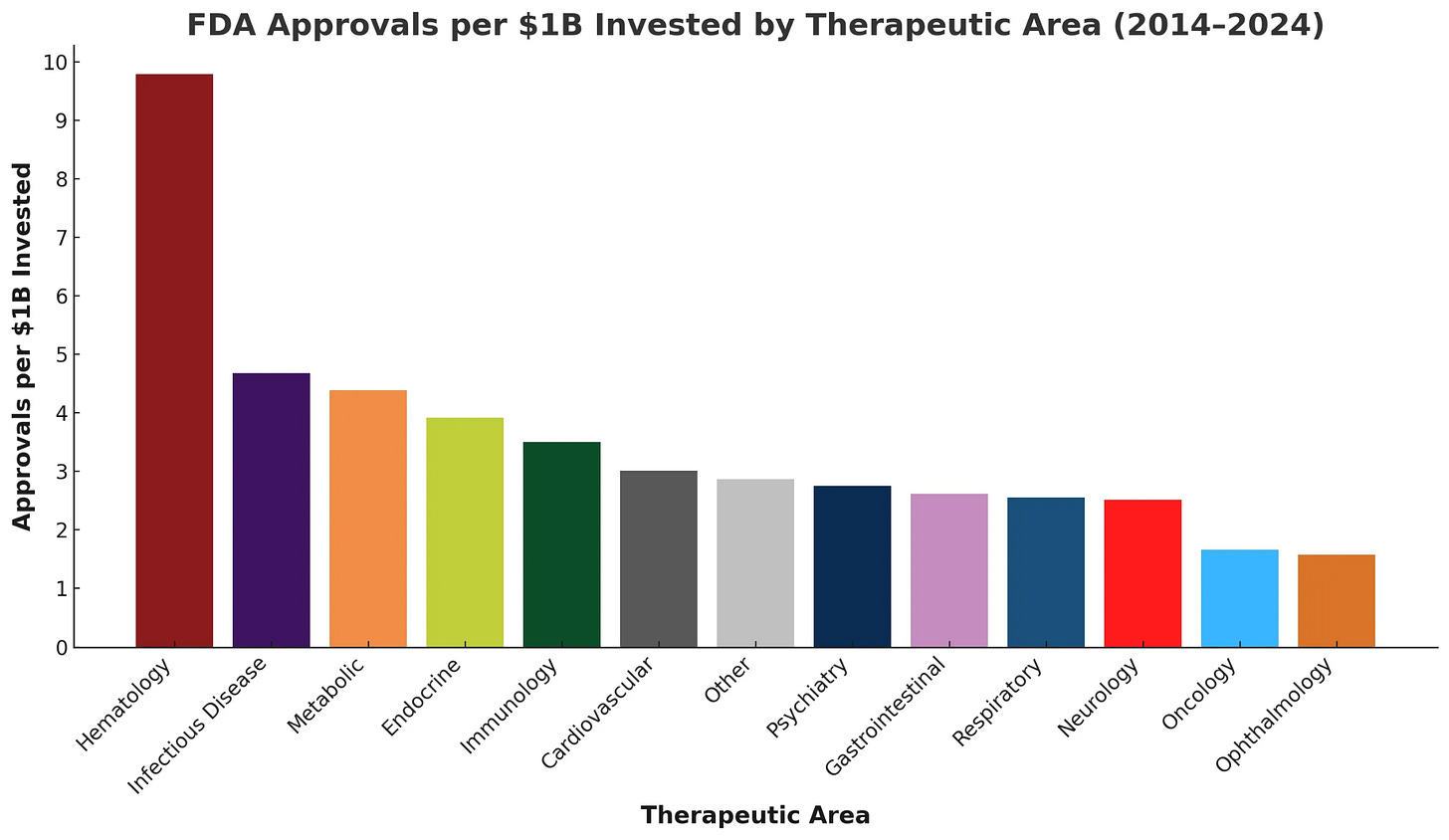

But when investment is normalized by the number of FDA approvals, the difficulty of developing therapies in this space comes back into view: neurology ranks as the third-lowest therapeutic area for approved drugs per $1B invested from 2014-2024.

What could spark renewed CNS investment by pharma?

You don’t have to squint much to notice the cyclic nature of drug development, especially in CNS. The initial spark of success with new targets and biological mechanisms for SSRIs clearly invigorated pharma investment at the turn of the century. If history seeks to repeat itself — and I think it will — the clinical validation of new therapeutic hypotheses that demonstrate disease-modifying impact may help reset expectations and redefine opportunities in CNS drug development.

In particular, neurodegenerative diseases like Alzheimer’s and Parkinson’s are among these areas overdue for fresh therapeutic hypotheses. They have long been the poster children for the difficulty of translating safe and effective therapies in neurology, and the limited clinical benefits from current approved drugs suggest there might be alternative disease mechanisms to target.

While exploring the neurology space, I kept coming back to the graph below of new drug approvals over the last 3 decades and how therapies for immunological diseases had more than doubled decade-over-decade, while neuro and psychiatry stayed relatively constant. One interpretation of this data is that decades of growing fundamental knowledge in immunology and our ability to manipulate it created the stored potential energy that, once released, drove a burst of rapid clinical translation.

Despite the similarly high complexity of the immune system, there are several potential reasons why the slope of progress in immunology has been generally faster than in CNS. For example, many immune cell types are easily obtained from a simple blood draw, can be reliably cultured and expanded ex vivo, and are directly targetable through IV drug delivery. Additionally, technologies like flow cytometry have enabled deep characterization of immune cells, and humanized mice have provided more therapeutically relevant preclinical models.

Just as researchers have targeted or leveraged the immune system in other indication areas (e.g. PD-1/PDL-1 inhibitors for solid tumor treatment), directly targeting the CNS immune system could open a path to disease-modifying therapies for Alzheimer’s and Parkinson’s, and early evidence linking immune pathways to neurodegeneration suggests this translation may already be within reach.

The promise of targeting neuroinflammation

Admittedly, I left out an important caveat from David Reese’s quote above on Amgen moving away from neuro R&D:

“Upon careful evaluation of our pipeline and the challenges inherent in developing drugs for major neurologic diseases, we’ve made the decision to end our neuroscience research and early development programs with the exception of programs centered on neuro-inflammation.” — Amgen R&D Head, David Reese, October 2019

The fact that large pharma like Amgen were cutting most early-stage neuro programs but making exceptions for neuroinflammation, in my opinion, makes this area especially compelling to explore more deeply.

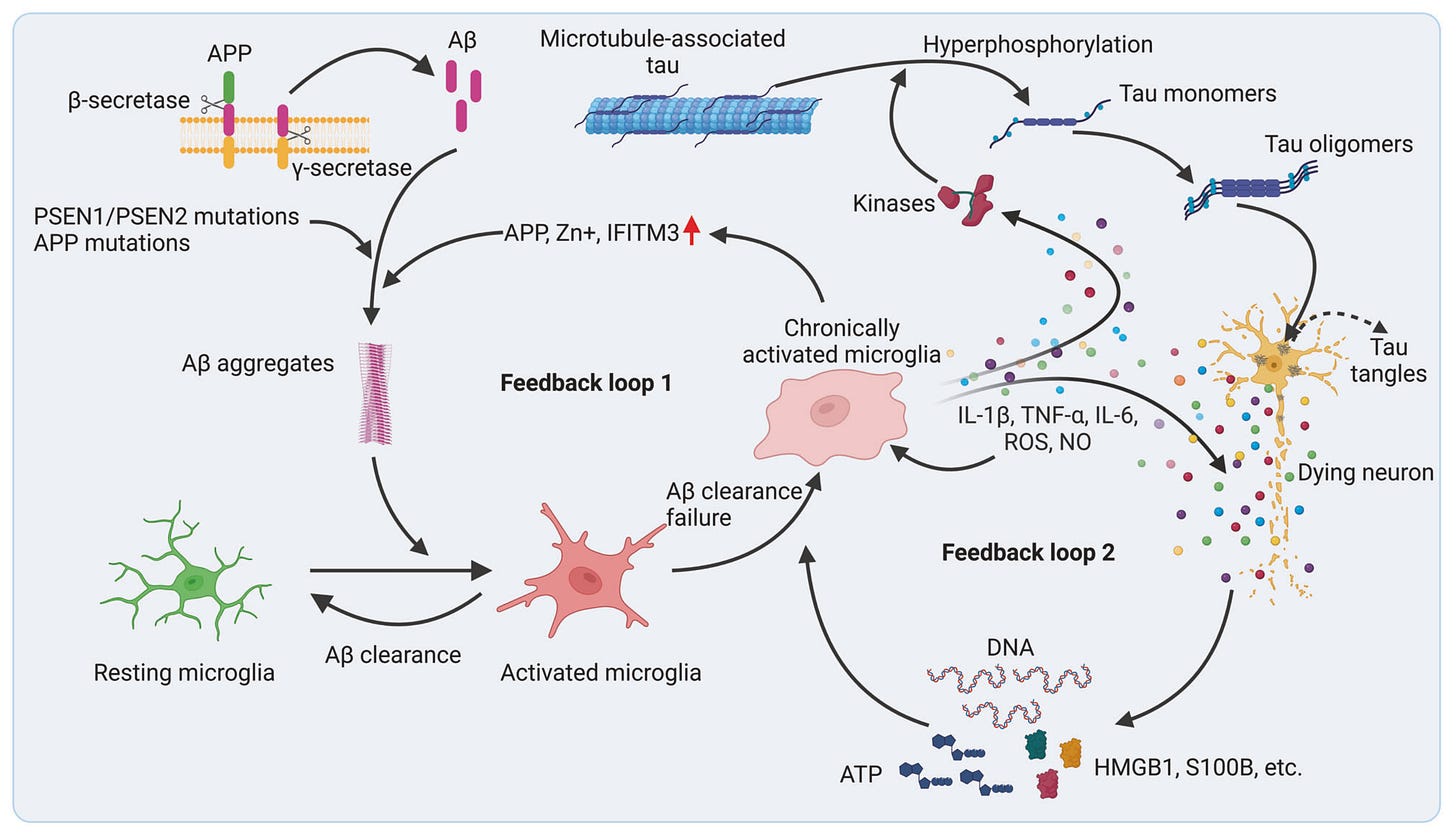

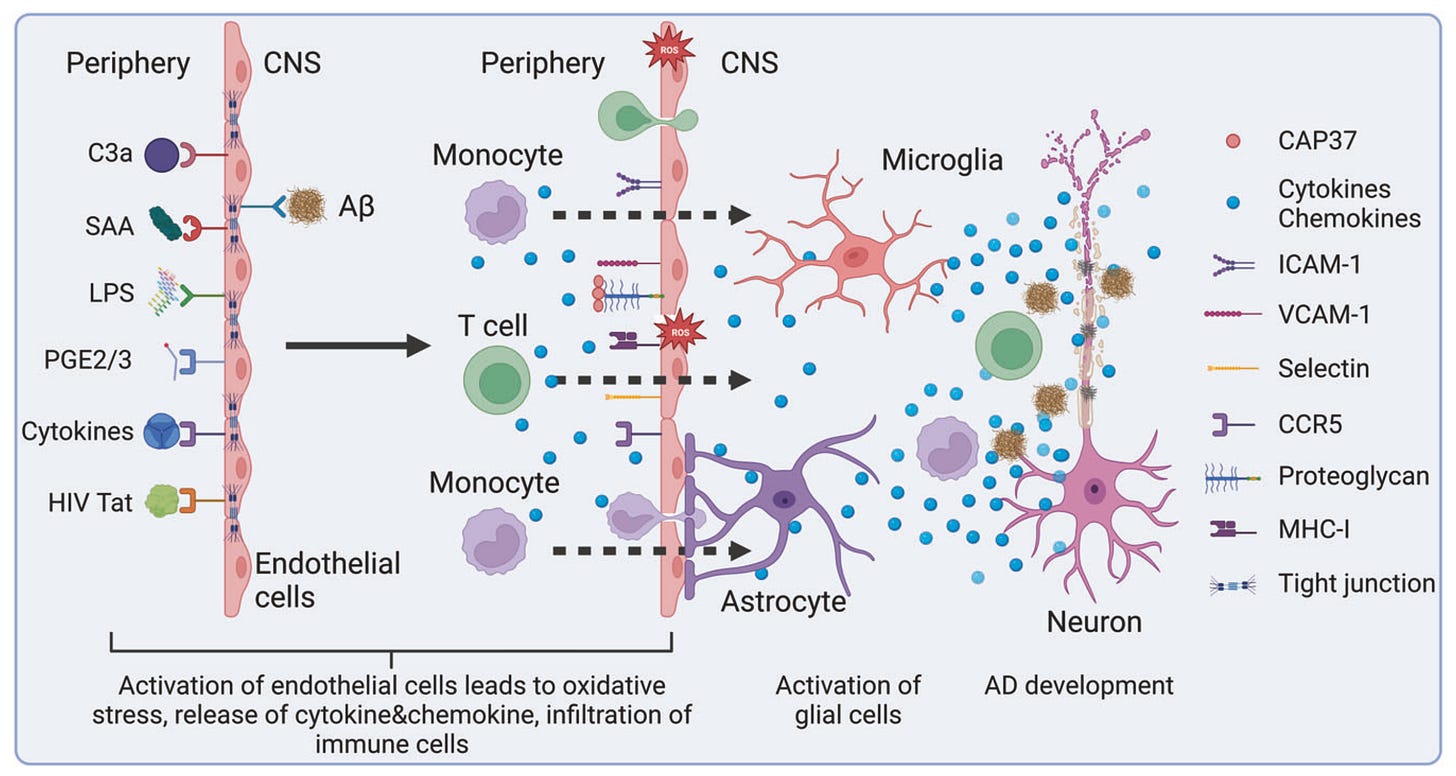

While the BBB typically limits cross-talk between the peripheral immune system and the brain, two CNS-native cell populations (i.e. microglia and astrocytes) carry out many similar immune-related functions. For example, microglia primarily respond and release inflammatory cues, clear debris, and prune weak connections (i.e. synapses) between neurons, whereas astrocytes also contribute to inflammatory cytokine production and synaptic pruning, in addition to maintaining BBB integrity.

Until recently, neuroinflammation in neurodegenerative diseases was seen mainly as a side effect of microglia and astrocyte activation in response to pathogenic protein aggregates and neuronal debris. However, more recently, there has been an ideological shift toward viewing neuroinflammation as a primary driver and trigger of neurodegeneration — driven by growing genetic links between microglia and Alzheimer's/Parkinson's, links between autoimmune and neurodegenerative disease incidence, and studies showing that long-term NSAID (i.e. anti-inflammatory) users had a 50% risk reduction of developing Alzheimer's.

In Alzheimer’s and Parkinson’s, genetic and environmental factors can drive astrocyte and microglia dysfunction, fueling a self-perpetuating cycle of inflammation, neuronal loss, and cognitive decline. For example, microglia respond to protein aggregates like amyloid-β and α-synuclein by releasing cytokines and complement proteins that damage neurons and prune synapses, while astrocytes lose homeostatic functions such as clearing excess glutamate and potassium, causing excitotoxic injury to neurons. This chronic inflammation also weakens the BBB, allowing infiltration of peripheral immune signals and cells that further damage neural tissue.

Clinical progress towards drugging neuroinflammatory targets

Today, several drug targets (e.g. TYK2/JAK1, TREM2, LRRK2, NLRP3, NEK7, C1q, KCNK13, S1P-R) are being explored for the treatment of neurodegenerative diseases in clinical trials, with many aimed at reducing chronic inflammation and redirecting microglia and astrocytes from an over-activated to homeostatic phenotype. While it’s still too early to know whether these targets will successfully translate and drive broader CNS investment (most are only in early Phase II trials), several promising candidates are worth discussing.

TYK2/JAK1

One of the most advanced programs in this area borrows target biology directly from the peripheral immune system. BHV-8000, an oral, brain-penetrant dual TYK2/JAK1 inhibitor from Biohaven, is being developed for Parkinson’s disease with the aim of blocking pro-inflammatory IFN signaling, reducing Th17 cell proliferation, and breaking the feedback loop of chronic neuroinflammation. After reporting a well-tolerated safety profile in healthy volunteers in Phase I trials, Biohaven recently dosed its first patient in a Phase II/III trial in May 2025.

Both JAK1 (e.g. Rinvoq, AbbVie, 2019; Xeljanz, Pfizer, 2012) and TYK2 (e.g. Sotyktu, BMS, 2022) have already been independently validated in several peripheral autoimmune and inflammatory diseases. These prior results offer not only confidence in the targets themselves but also provide valuable insights from past trials that could help increase the probability of translating these approaches to CNS diseases.

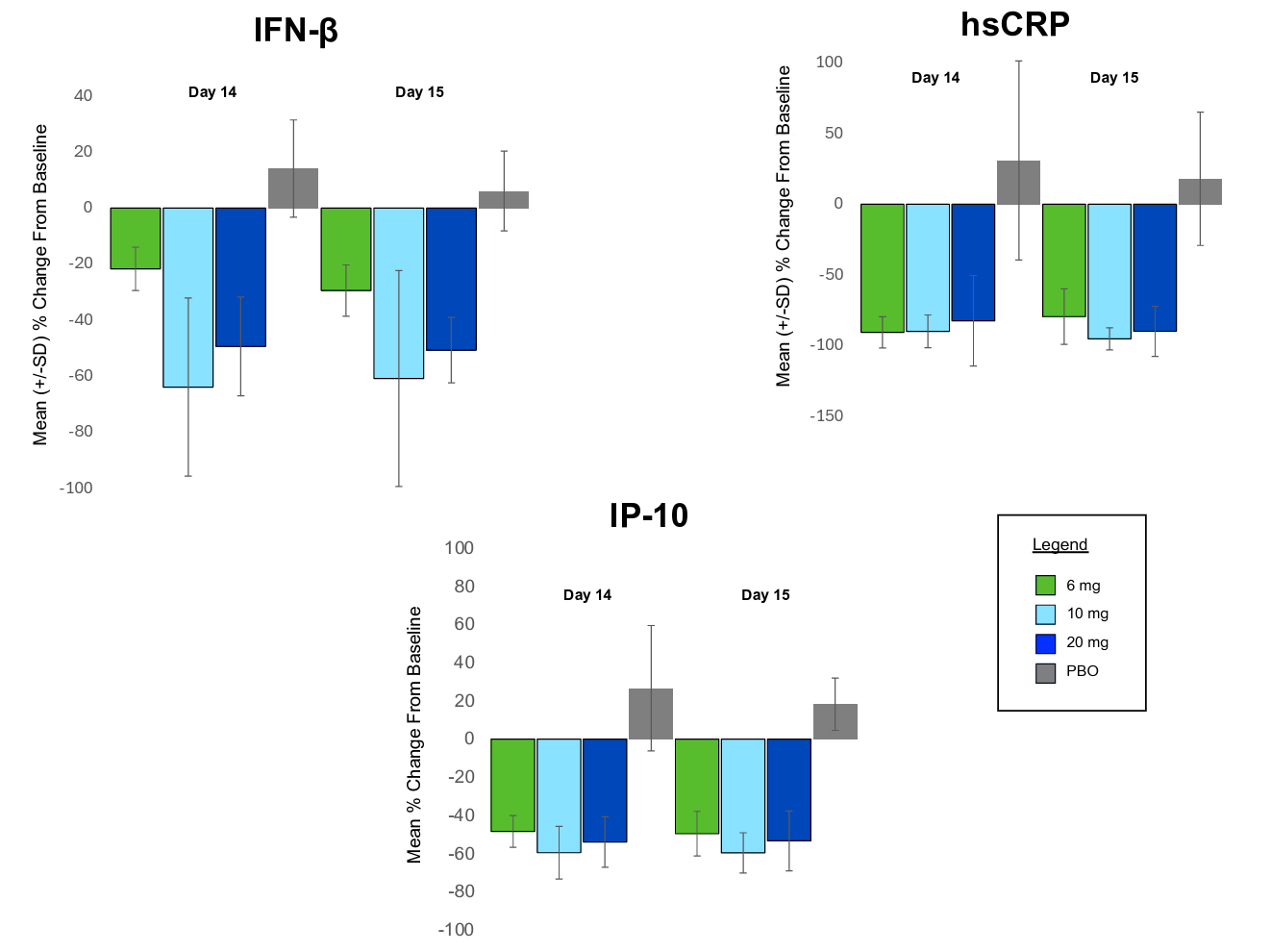

For example, a major roadblock in CNS drug development has been the lack of reliable biomarkers to assess target engagement. One advantage of leveraging known immune biology is the ability to borrow validated biomarkers from other peripheral immunology trials: BHV-8000’s Phase I data showed significant reductions in TYK2/JAK1-related inflammatory markers (e.g. IP-10, hsCRP, IFN-beta) versus placebo, providing greater confidence in target engagement heading into later-stage trials.

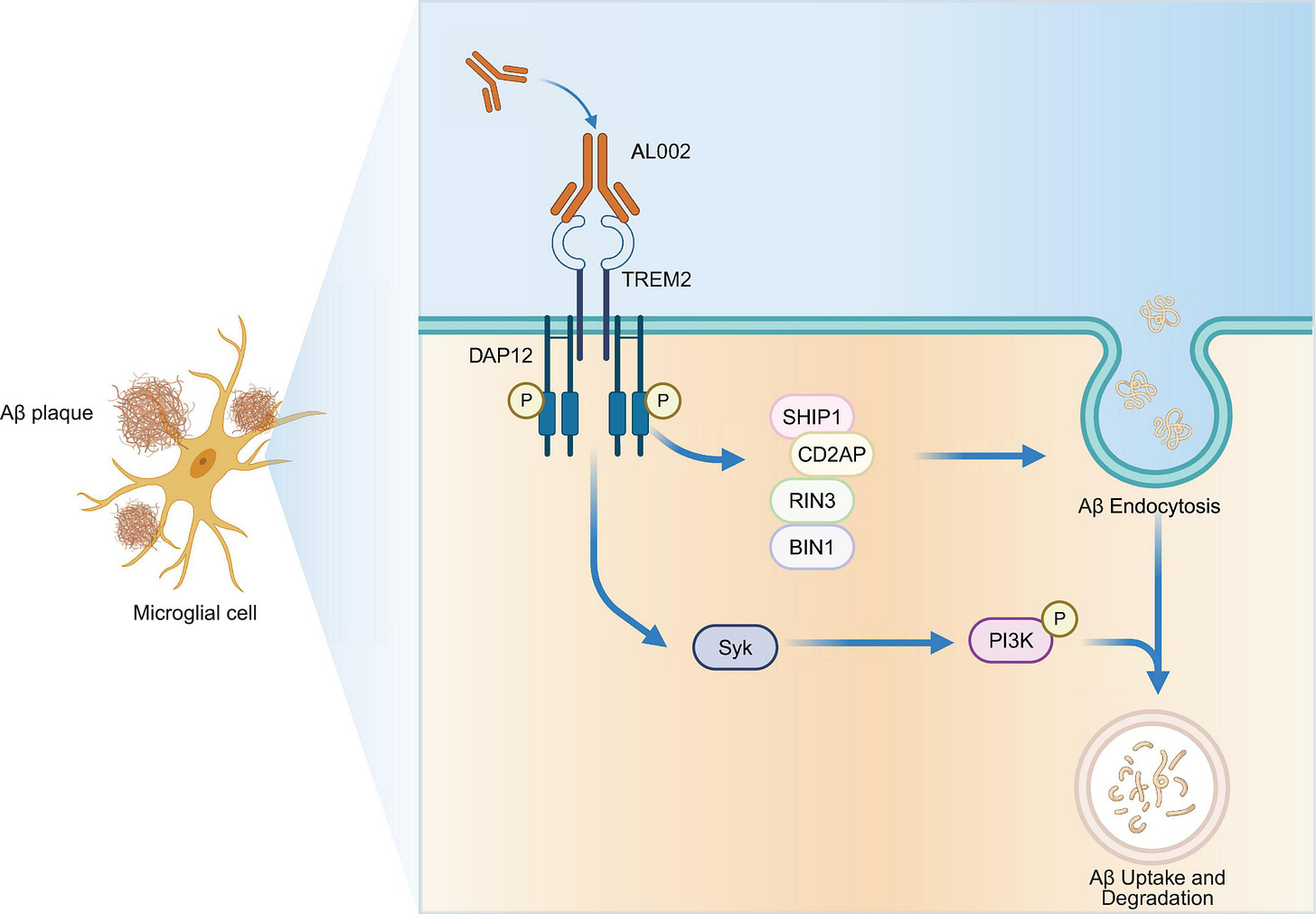

TREM2

TREM2 is another well-studied neuroinflammation target, in part because the loss-of-function R47H variant is one of the strongest genetic risk factors for Alzheimer’s. Specifically, TREM2 is expressed on the surface of microglia and is activated by phospholipids, protein aggregates, and apoptotic debris that triggers a neuroprotective state with decreased inflammatory cytokine production. The therapeutic hypothesis is that TREM2 agonism could boost microglial survival and phagocytosis to clear the protein aggregates that fuel chronic inflammation and drive the perpetual cycle of neuronal cell death.

Despite early promise, TREM2 agonists have been plagued by clinical trial failures due to both poor safety margins and limited efficacy (e.g. Alector, Denali, Vigil). While the exact reasons behind these failures are still up for debate, nuances around genetic variation and disease stage may play a role.

Nonetheless, a recent acquisition of Vigil Neuroscience by Sanofi for $600M for their Phase I oral, small molecule TREM2 agonist demonstrates the field still sees some promise.

There is a likely reason for Sanofi’s optimism here. Many antibody-based TREM2 agonists struggle to distinguish between the membrane-bound receptor and its soluble form, which can act as a sink and reduce effective target engagement. To address this, Vigil’s small molecule targets only membrane-bound TREM2, allowing it to avoid the therapeutic sink. Notably, Vigil’s TREM2 antibody agonist that was discontinued after a failed Phase II clinical trial for ALSP, a rare neurodegenerative disease, was not included in the sale.

LRRK2

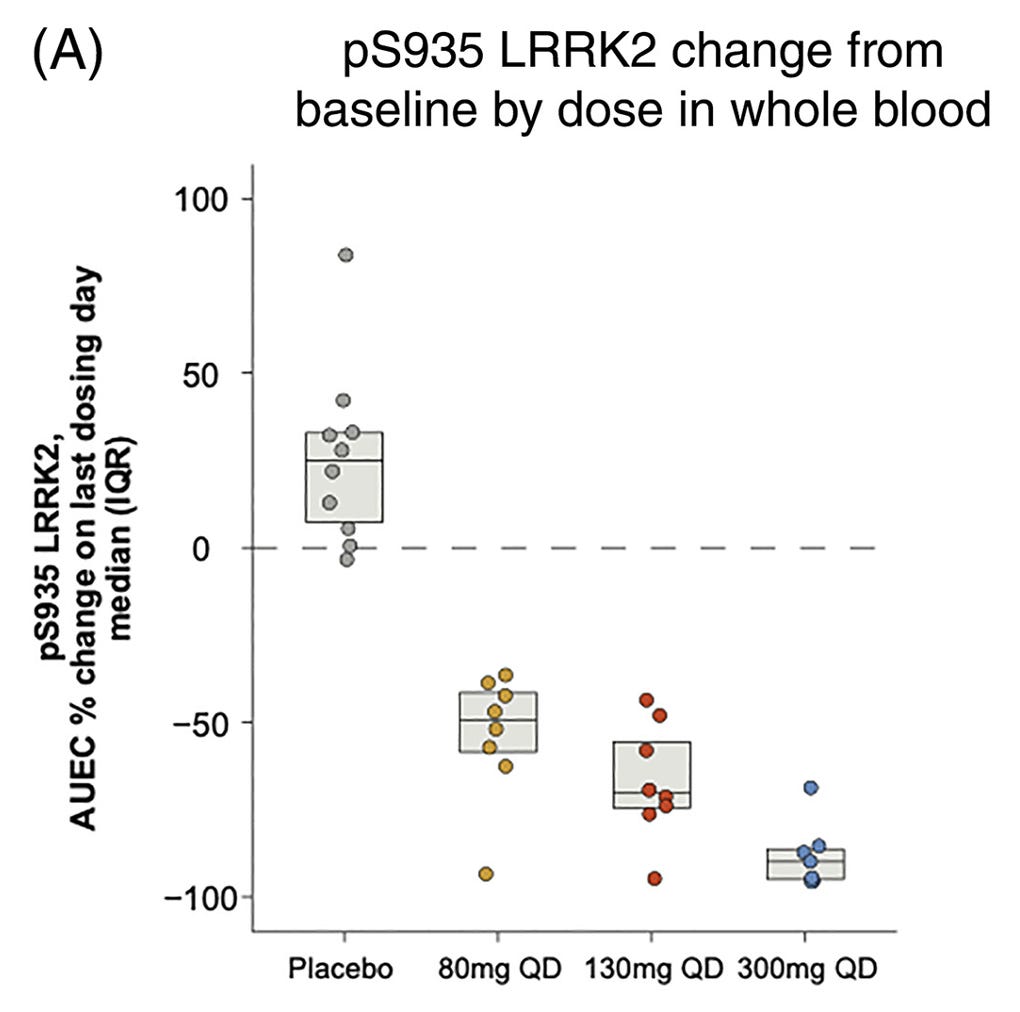

LRRK2 is a kinase expressed in both neurons and glial cells and is one of the most common genetic risk factors for Parkinson’s disease. Biologically, it plays a key role in regulating lysosomal function, and its over-activation in Parkinson's is thought to impair waste clearance, resulting in the buildup of α-synuclein aggregates that promote neurodegeneration and drive downstream neuroinflammation.

In the past year, LRRK2 has gained major attention as Denali/Biogen and Neuron23 each began Phase II trials of their LRRK2 inhibitors, dosing the first patients with LRRK2-associated Parkinson’s disease. Notably, the same Denali/Biogen drug is also currently being tested in a Phase IIb trial for Parkinson’s patients with or without an LRRK2 mutation that began in May 2022 and has an expected readout later this year.

Early pharmacodynamic studies from Denali/Biogen’s Phase Ib trial in Parkinson’s patients showed encouraging results. Specifically, phosphorylation of LRRK2 in whole blood decreased in a dose-dependent manner versus placebo, confirming target engagement. Time will tell whether these results translate to meaningful efficacy readouts in current Phase II studies.

Outlook

It’s probably unrealistic to expect that any single target, therapeutic hypothesis, technology, or company will simultaneously solve all the challenges that plague CNS drug development. Long-term progress will likely require steady investment in breakthroughs that, together, create the rising tide that lifts all boats.

That said, there are several lessons we can learn from our past success in targeting the peripheral immune system that can guide new therapeutic hypotheses and catalyze drug development for CNS disorders:

Novel targets and improved biological understanding.

Given the limited success of current neurodegenerative treatment strategies, broadening the target space to immune-related pathways will help promote exploration of new therapeutic hypotheses and deepen our understanding of fundamental neurobiology and CNS disease mechanisms.

Borrowing biomarkers from I&I.

The wide range of immunological biomarkers and our improved understanding of immune cell pathways have undoubtedly increased the probability of success in I&I drug development. Targeting brain-resident immune cells such as microglia and astrocytes — which share many signaling pathways with peripheral immune cells — could allow the use of the same validated PD biomarkers in neurology.

Avoiding the BBB altogether.

Crossing the BBB remains a major challenge for CNS drug development. However, the field is beginning to understand how peripheral immune signals — both soluble factors and cells — also influence neurodegeneration as they pass through the compromised BBB. This may open the possibility of treating CNS diseases by targeting peripheral immune signals without needing to cross the BBB in the first place.

Expansion beyond neurodegeneration.

We know the immune system can be uniquely targeted to treat diverse disease areas like cancer, fibrosis, and metabolic diseases. The same principle likely applies to the CNS, and the potential to target neuroinflammation extends beyond the initial push into Alzheimer’s and Parkinson’s. Just as Prozac and Zoloft quickly expanded to multiple indications, restoring immune cell homeostasis could also benefit other CNS disorders, including multiple sclerosis and autism spectrum disorder.

One lingering concern I have is whether targeting neuroinflammation can truly reverse neurodegeneration rather than just slow or stabilize it. I have yet to see much evidence that disrupting the pro-inflammatory positive feedback loop would necessarily also catalyze neuronal regeneration, but we need more data, and likely more regenerative approaches for treating late-stage patients. This also underscores the perennial need for early-detection technologies that can avoid irreversible neurodegeneration in the first place.

Overall, it’s still relatively early days for targeting neuroinflammation, and there are several fundamental unknowns to address including identifying which cell types, pathways, and drug targets can deliver durable, disease-modifying outcomes amidst the complexity of CNS inflammatory feedback loops. A clear clinical success validating a therapeutic hypothesis like neuroinflammation could be the turning point that reframes the outlook for neurodegenerative disease treatment and neuro writ large.

If you are working in this space and have any comments/opinions about neuroinflammation or other emerging therapeutic hypotheses in neuro, feel free to reach out!

Good piece here! Fully agree with the reversal issue vs. slow progression of neurodegeneration.

A key challenge seems to be when to target the glial cells too. Too early/ too late? TREM2 is a good example; too much agonism shuts down downstream signaling (desensitization).

Not to mention, which biomarkers to think about for neuroinflammation or how to consider (or if?) oligodendrocytes.

See recent papers & reviews from Li Huei Tsai et. al for impact of oligos.

This is a cut and paste from another article. Thoughts?

Check this out…

For me and Al:

“4.1.1 Bezisterim (NE3107): A Novel Anti-Neuroinflammatory Agent

A leading example of a novel, purpose-built therapeutic is bezisterim (also known as NE3107).80 Bezisterim is an orally bioavailable, small-molecule drug that can cross the blood-brain barrier, a crucial property for treating CNS conditions.82 It functions as an anti-inflammatory insulin-sensitizer with a novel mechanism of action that involves the selective modulation of the transcription factor Nuclear Factor kappa B (NF−κB) activation, a master regulator of inflammation.81 By binding to the extracellular signal-regulated kinase (ERK), bezisterim inhibits inflammatory signaling and reduces the production of key cytokines like TNF−α, without disrupting the homeostatic functions of these pathways.82”