Don't Fall in Love with Your Molecule

Technical success doesn't guarantee market success. This essay explores how target product profiles align discovery with demand to build enduring, commercially-viable biotechs.

Chapters

This essay was co-authored by Simon Barnett, Partner at Dimension and Anna Kostikova, Senior Director of Data Science and Computational Biology at Monte Rosa Therapeutics. The views expressed are those of the individual authors and do not necessarily represent the views of Monte Rosa Therapeutics.

Forward

Technical success—lovely, but inadequate.

Bluebird Bio achieved a scientific triumph in 2022 when the FDA approved its lead asset Zynteglo, a first-of-its-kind gene therapy offering curative potential for transfusion-dependent β-thalassemia (TDT). Since Zynteglo’s launch, however, Bluebird’s stock (BLUE) has fallen 97%, and the company was ultimately taken private for roughly $30 million—a far cry from the biotech’s peak valuation of $10 billion.

Bluebird was an excellent organization filled with brilliant scientists and skilled operators. However, its story offers an opportunity to understand what went wrong and how emerging biotechs can more effectively navigate commercial pitfalls.

Despite groundbreaking science, Zynteglo failed to gain commercial traction—not because it didn’t work, but because it entered a healthcare system unprepared to reimburse the $2.8 million list price.

The key foot fault was the target product profile (TPP). Although Bluebird’s TPP addressed a large clinical unmet need and accurately anticipated regulatory approval, it failed to align clinical ambition with market access and reimbursement hurdles.

Today’s biotech ecosystem overemphasizes technical success. Claims like, “Our platform technology increases the probability of technical success by 20%” ring hollow against a backdrop where only half of FDA-approved molecules recoup their R&D investments. Technical success is a necessary, but insufficient condition for building an enduring biotech.

Early, frequent, and rigorous TPP construction is crucial for calibrating R&D efforts to commercial realities—such as pricing tolerance and payer readiness—ensuring that drugs achieve both technical and market success.

Origin of the Target Product Profile

Nearly twenty years ago, the FDA consolidated a patchwork of internal, pharma working documents into the original incarnation of the TPP.

While TPPs vary between organizations, the modern framework captures essential information about a product’s intended population, differentiation from the established standard of care (SoC), administration and dosing considerations, and market access insights. TPPs are ubiquitous today—but this wasn’t always the case.

Decades ago, pharma companies used a fragmented mix of internal target labels and regulatory briefing documents to guide drug development. These tools lacked standardization, version control, digitization, and mechanisms for cross-functional collaboration between R&D and commercial teams. Early guiding frameworks often omitted market access strategy altogether.

The FDA formalized the concept in its 2007 draft guidance, positioning the TPP as a tool to help sponsors “begin with the end in mind”. Ideally, the TPP bridges development and regulatory planning—clarifying intent-to-treat sub-populations, efficacy targets, safety margins, and more, each supported by a clear trail of preclinical data.

Industry Pushback and Modernization

The modern TPP is a data-driven dashboard meant to serve as a substrate for debate and decision making.

Initially, there was industry pushback. Pharma companies were concerned that TPP claims might be seen as binding or interpreted as overly promotional. Many drug developers rightly pointed out that the FDA’s draft guidance was intended to galvanize regulatory efficiency—not to ensure commercial success. This perceived gap drove the modernization of the TPP into something more than a regulatory artifact. TPPs are now business plans in disguise.

Today’s TPPs are highly dynamic, data-fed tools that help nimble teams develop drug products addressing clinical and commercial gaps. Against a highly competitive backdrop, TPPs are moving targets, informed by constant shifts in the global development landscape and scientific breakthroughs alike.

Modern TPPs often include both minimal and preferred outcomes, a precedent popularized by the World Health Organization (WHO) and now widely adopted across industry. Compared to earlier versions, TPPs are now intended to serve diverse audiences, including patients, clinicians, regulators, payers, pharmas, biotechs, investors, health technology assessment (HTA) bodies, and others.

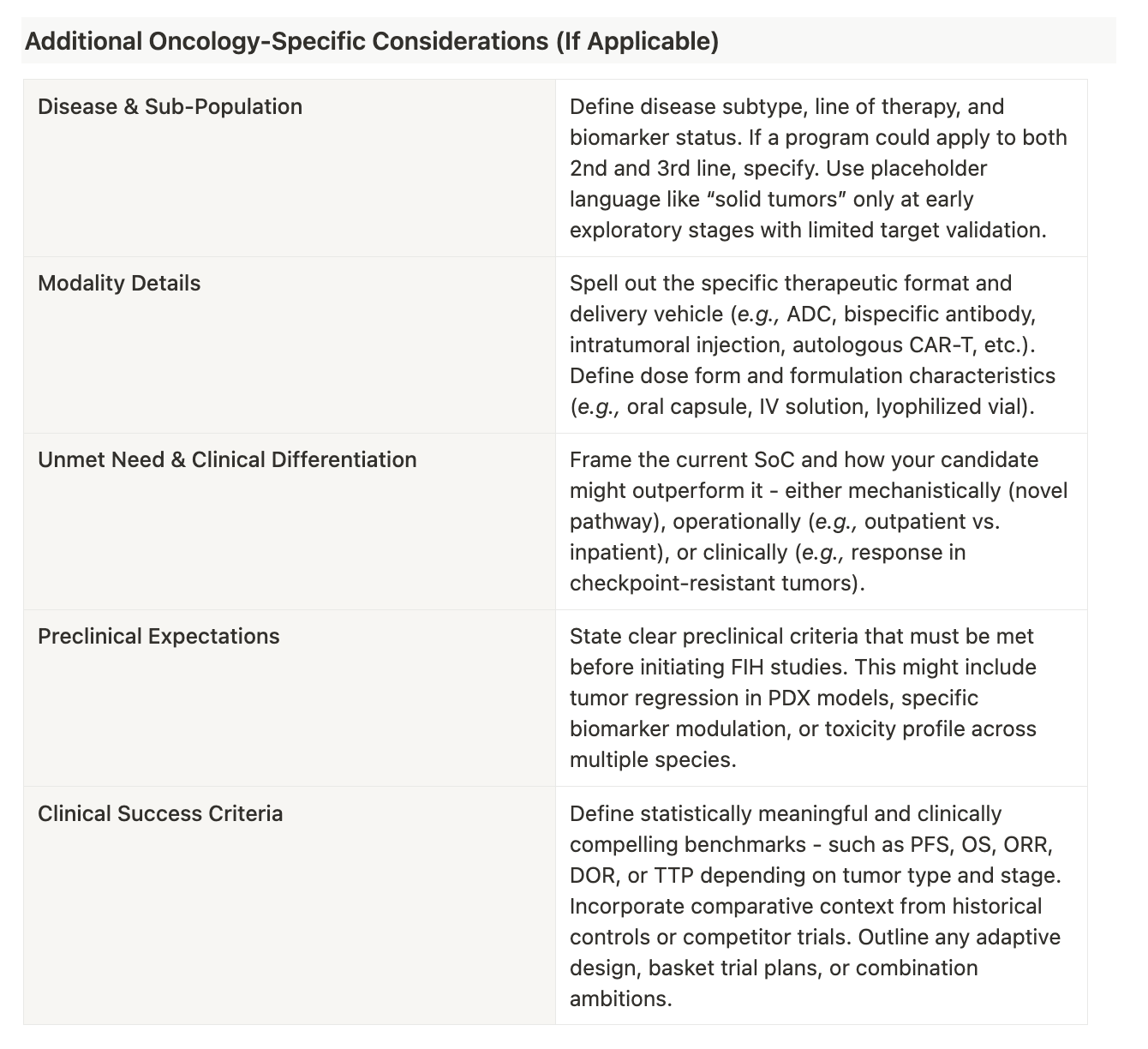

Below is an example of what a modern-day TPP may look like along with suggestions for how to fill one out:

Deciphering Some Examples

For either molecule to succeed commercially, the convenience and tolerability advantages must produce clinical outcomes that matter to patients, providers, and payers.

In highly saturated therapeutic areas, successful differentiation hinges on a nuanced understanding of what truly matters to patients, clinicians, and payers. Below are two illustrative examples of how different product profiles aim to carve out space in competitive environments—one through delivery convenience and the other through safety optimization.

In the rapidly evolving multiple myeloma landscape, BCMA is a well-validated target. Several high-efficacy therapies are already approved or in late-stage development, including CAR-Ts, bispecifics, and antibody-drug conjugates. However, many of these treatments are logistically complex—requiring intravenous (IV) administration, hospitalization, or specialized centers.

This hypothetical, oral BCMA inhibitor aims to differentiate by offering an at-home alternative, reducing treatment burden and improving access for a broader patient population. The convenience of a pill—especially for relapsed/refractory patients with limited mobility or other logistical constraints—could drive wider adoption. Still, in a space dominated by potent biologics, clinical performance must clear a high bar to gain meaningful market traction.

Lerociclib, an oral, highly selective CDK4/6 inhibitor, takes a different angle—refined tolerability. The program emphasizes a continuous daily dosing strategy in combination with fulvestrant, aiming to deliver efficacy on par with other CDK4/6–endocrine therapy combinations.

The molecule’s core differentiator lies in reducing the toxicity burden commonly associated with the drug class. Early data suggest lower rates of Grade 4 neutropenia, gastrointestinal adverse events, fatigue, stomatitis, and alopecia—side effects that often constrain adherence or impair quality of life. If these results hold in larger trials, lerociclib may appeal to patients and clinicians prioritizing long-term safety and tolerability.

CDK4/6 inhibitors like palbociclib, ribociclib, and abemaciclib are deeply entrenched, with substantial clinical and real-world data. For lerociclib to succeed, its safety advantages must translate into outcomes that influence not just clinical theory, but real-world prescribing behavior and payer decisions.

A Tale of Two TPP Construction Philosophies

Each philosophy has merit and has produced commercially impactful drugs.

There are two basic strategies for building an initial TPP—top-down and bottom-up. Both seek to bridge molecules and markets, but they begin from different starting points.

Top-down strategies start by identifying intersections of clinical unmet need and commercial tractability. Organizations then hone in on novel or underserved biological pathways that may address these market opportunities. With a target hypothesis in hand, technical leaders converge on the best modality, pharmacology, and molecule.

Consider the success of CAR-T cell therapy for hematological malignancies which followed this approach. Historically, patients with relapsed or refractory B-cell cancers (e.g., acute lymphoblastic leukemia (ALL)) had few options following chemotherapy and stem cell transplant failure. Oncologists had long recognized this treatment gap, but lacked a viable solution until scientists discovered how to reprogram T-cells to recognize and destroy cancer cells.

Instead of starting with “we need a CAR-T therapy,” companies like Novartis (Kymriah) and Gilead (Yescarta) worked closely with oncologists and hematologists to understand which cancers were most likely to benefit from CAR-T therapy. They honed in on CD19 as an ideal target antigen given it’s widely expressed on B-cells and had limited off-target toxicity concerns. This top-down approach, which started with a clearly defined unmet need and mapped backward to a druggable target, catalyzed a revolution in personalized cancer treatment.

Bottom-up strategies begin with targets and molecules. Teams winnow the target space by considering what a drug modality or technology platform can best address. Can the molecule access intracellular or only secreted targets? Can it be administered orally or only parenterally? Is the discovery platform excellent at tuning selectivity within a certain target family?

Armed with a refined target list, teams scour the disease landscape for pathophysiologies involving those targets. Finally, multi-stakeholder input helps match indications to underserved patient populations with both clinical urgency and commercial potential.

The development of a gene therapy for spinal muscular atrophy (SMA) embodies this approach. SMA is a devastating genetic disease caused by mutations in the SMN1 gene, leading to progressive muscle weakness and early mortality in infants. For years, SMA management was limited to supportive care since traditional drug modalities couldn’t address the underlying genetic error.

Researchers saw gene therapy as a means to restore SMN1 function by delivering a healthy copy of the gene. Instead of pursuing a treatment for broad neuromuscular disorders, AveXis (developer of Zolgensma) focused on a precise genetic target and built a TPP around the most clinically and commercially viable scenario—early intervention in infants before irreversible damage occurs. This bottom-up strategy, starting with an accessible genetic target and then identifying the right disease context, delivered a breakthrough therapy that transformed SMA treatment.

Universal Guiding Principles

TPPs aren’t static blueprints—they’re evolving hypotheses shaped by data and decision making.

Most organizations employ different design methods concurrently, facilitating an 'iron-sharpens-iron' exchange of perspectives. Contrary to a common belief, companies rarely finalize a TPP before initiating discovery and development. Instead, they iteratively converge on viable market—molecule pairings.

A biotech may generate a hit in early screening and then build a rudimentary TPP or target scorecard to see if it’s worth prioritizing. A pharma company may run a salvo of light-touch TPPs across an underserved therapeutic area to determine which targets warrant full-scale R&D investments.

This iterative strategy is exemplified by the CRISPR-Cas9 approach to sickle cell disease (SCD). Early CRISPR research broadly targeted genetic diseases without a clear beachhead indication. Companies like Vertex and CRISPR Therapeutics refined their focus through repeated cycles of assessing scientific feasibility and market need—ultimately landing on ex vivo editing of hematopoietic stem cells for SCD and β-thalassemia.

Regardless of the starting point or design philosophy, these guiding principles are perennially useful for building effective TPPs.

Create Dynamic, Data-Driven TPPs

TPPs should be living documents, housed in tech-enabled infrastructure capable of adapting to market ebbs and flows. Teams should consider not only the current SoC, but where the cutting edge of medicine may be in ten years. Feed in commercial intelligence, emerging scientific trends, and patent expiry timelines to make a TPP anti-fragile.

Involve Multiple Stakeholders Early and Often

Robust TPPs incorporate input spanning regulatory, commercial, R&D, market access, and translational domains. It’s also never too early for teams to engage payers, physicians, and patients. Discussions with these groups ensure that TPPs are grounded in what actually drives demand and uptake.

Consider the Therapeutic Backdrop

TPPs should be attuned to the nuances of their therapeutic category. For example, immunology and inflammation (I&I) indications have high efficacy bars. Given that these are often chronic conditions, long-term tolerability and friendly routes of administration (ROA) offer chances for differentiation.

Be Ambitious and Quantitative

Target and indication crowding mean that small improvements get lost in the noise. TPPs should be built around bold—but quantifiable—aspirations. Directional ambition isn’t enough. Teams should quantify the performance lift needed to leapfrog competitors.

Foster a Translational Mindset

Trials should be engineered to cleanly demonstrate key TPP differentiators. Teams should focus on endpoints incorporating accepted biomarkers and statistically powered to show value. Meanwhile, layering in clinician insight helps streamline enrollment. If patients can’t be found in the context of a trial, they’ll never be found in the real world.

Account for Psychology

Pharmas and biotechs alike are intelligent superorganisms, but they’re not infallible. Even stellar organizations fall prey to internal bias. It’s easy to fall in love with a promising lead series or a tantalizing TPP wedge—but this shouldn’t come at the cost of holding onto a doomed development campaign. Teams must define performance thresholds early and commit to dispassionately pruning programs when the cards flip over.

Have Contingency Plans

TPP design should be flexible. Markets are dynamic. Competitors pivot. Teams should build for label expansion and strategic rebuttal. Having a fallback plan—or two—ensures that value gets unlocked even if the initial TPP scenario disappears.

Pharma and Biotech Perspectives

In the fog of war, it’s easy for strategy and technical teams to fall out of sync. TPPs are the connective tissue between teams, preventing faultlines from forming.

Large pharmaceutical companies maintain vast TPP archives which they deploy across a variety of use cases—from internal investment planning to lifecycle management.

Despite commanding fleets of internal R&D teams, large pharmas don’t address every TPP gap organically. They wield TPPs like shopping lists. As business development teams walk through aisles of biotech assets, TPPs provide an easy rubric for discerning whether programs may align with future pipeline needs—whether for partnership, in-licensing, or outright M&A.

Established pharmas possess an information advantage on paper. Shouldn’t an ocean of historical TPPs and market data combined with massive infrastructure make it easy to come up with winning product ideas? The reality is murkier. Large pharmas are oftentimes structurally fragmented—amalgamated over decades of M&A and operating with pseudo-independent siloes. Big pharmas also aren’t tech companies. Interdivisional coordination, systems integration, and internal sign-offs pose formidable obstacles for truly benefiting from information asymmetry.

Understanding how pharma uses TPPs, emerging biotechs should hone their product strategies to increase the odds of productive partner engagement.

Biotechs have it tough. Young companies are capital-constrained, speed-obsessed, and laser-focused on mid-term value inflection. Biotechs may slack on robust TPP development, causing management and technical leadership to fall out of lockstep.

Fortunately, including voices from regulatory, commercial, and market access domains is becoming easier. Input may come from experienced advisors, speciality consultants, and a new wave of pipeline and business intelligence (BI) tools. Even open-source Deep Research models can serve as a starting point.

TPPs can also serve as deal accelerants. Transactions with large pharma remain the primary source of non-dilutive capital and exit liquidity in biotech. Having credible TPP documentation on hand streamlines partnership diligence and invites constructive feedback.

Parting Thoughts

TPPs are a pharmaceutical prime directive.

Crafting and maintaining a rigorous target product profile has never been more important. The pharmaceutical landscape is increasingly noisy and crowded—with targets and patient segments saturated by incremental “me-too” therapeutics. Adding to the pressure is large pharma’s growing ability to source low-cost molecules from China, posing a serious threat to the primary source of exit liquidity for Western biotechs.

Despite the headwinds, the technological backdrop for emerging biotechs has never been stronger. A growing suite of digital tools is reshaping strategy development, ranging from commercial intelligence platforms to real-time market access data brokers to cross-functional pipeline optimization engines.

Whether teams choose to engage specialty consultants or build internal capabilities, the modern biotech strata have ample resources to align scientific and commercial teams with managerial vision. For burgeoning companies aiming to attract strategic partnerships or investor attention, the TPP muscle is no longer optional—it’s imperative for survival.

There’s much to like in this post but I’d like to add a few thoughts. First off many emerging biopharma companies tend to be a bit “lopsided”-far stronger in the “science” than on the commercial side and this may be reflected in the choice of CEO. Second, cash is always constrained so often a company will need to prioritise its assets and potentially its indications within a single asset. Third, it’s often easy to assume that superior pre-clinical data (eg target affinity) will effortlessly translate into a meaningful clinical profile. Finally beware of KOL interviews which often inform the TPP. KOLs are great at discussing the current landscape but they have a mental model which may preclude or downplay genuinely novel approaches which could change the treatment paradigm.

100% agree with the statement "many emerging biopharma companies tend to be a bit “lopsided”-far stronger in the “science” than on the commercial side and this may be reflected in the choice of CEO." Except I'd change from the words 'commercial side' to "development side". I have spoken to several CMOs in emerging companies and their backgrounds mostly in translational discovery side worked in big pharma and then suddenly jump to small companies with Chief medical officer roles with no drug development experience but only at early discovery science. Then they start hiring development experts i.e. Reg Affairs, Clinicians etc at lower level and this contributes to the failures of several promising projects due to nonalignment of development strategies leading to failures!